Conversely, variable costing only includes variable manufacturing costs in the cost of inventory. Fixed manufacturing overhead costs are expensed in the period they are incurred and do not impact the valuation of inventory. Therefore, the value of inventory under variable costing is lower compared to absorption costing. The treatment of fixed manufacturing overhead is the only difference between the two costing methods.

- Absorption and variable costing are two common methodologies used to allocate manufacturing costs.

- For example, a company manufacturing products with high indirect costs would likely use absorption costing.

- For example, if you know that your company’s rent will increase next year, you can use the period cost per day to estimate how much this will increase your monthly expenses.

- The absorption costing method is typically the standard for most companies with COGS.

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

The other main difference is that only the absorption method is in accordance with GAAP. One of the main advantages of choosing to use absorption costing is that it is GAAP compliant and required for reporting to the Internal Revenue Service (IRS). The term “absorption costing” describes the method of accounting for a cost that is applied in vertically integrated organizations. Whichever costing method a company selects to use for accounting purposes, there are advantages and disadvantages.

Managerial Accounting

Absorption costing is considered the standard approach under generally accepted accounting principles (GAAP). By allocating fixed manufacturing costs to inventory, absorption costing better matches expenses to revenues. This means that a portion of fixed overhead is allocated to each unit produced.

Find the talent you need to grow your business

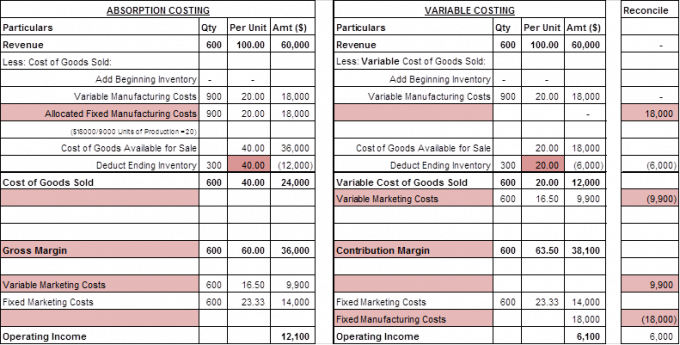

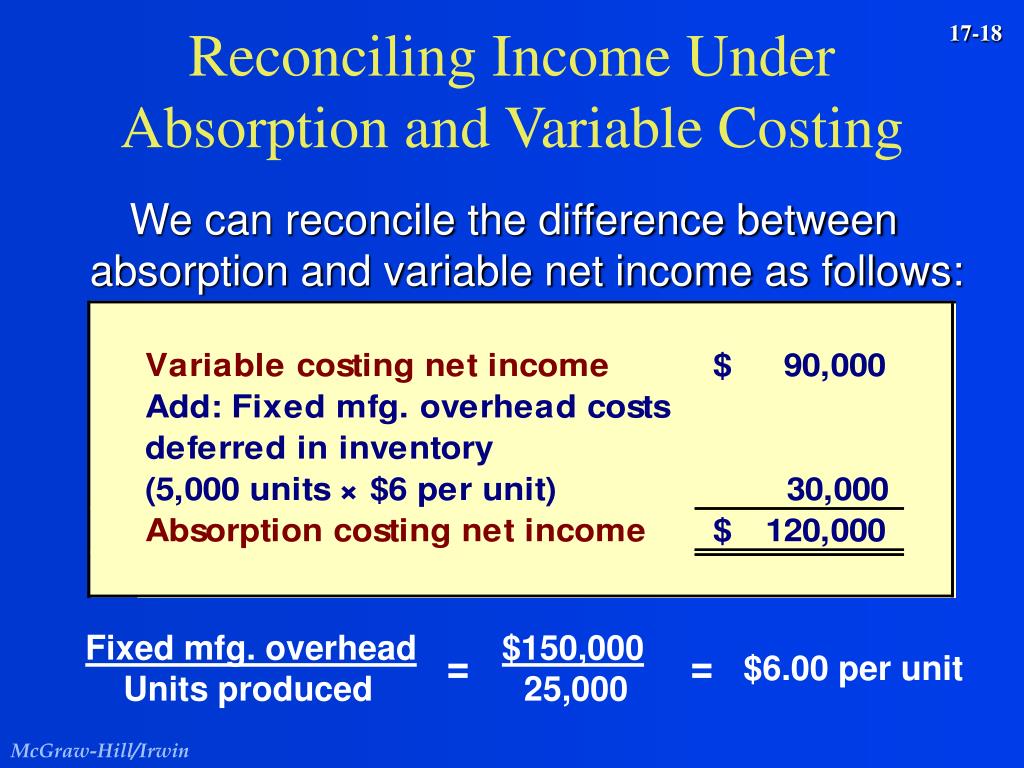

As a result, the value of inventory under absorption costing is higher compared to variable costing. If the entire finished goods inventory is sold, the income is the same for both the absorption and variable cost methods. The difference is that the absorption cost method includes fixed overhead as part of the cost of goods sold, while the variable cost method includes it as an administrative cost, as shown in Figure 6.12. For example, assume a new company has fixed overhead of $12,000 and manufactures 10,000 units. Direct materials cost is $3 per unit, direct labor is $15 per unit, and the variable manufacturing overhead is $7 per unit.

Impact on Profitability Analysis

Absorption costing may be more suitable for companies that have a high proportion of fixed manufacturing overhead costs and stable inventory levels. It provides a comprehensive view of the cost of production and can help in setting appropriate selling prices to cover all costs. The different treatment of fixed manufacturing overhead costs in absorption costing and variable costing also affects the valuation of inventory. Under absorption costing, fixed manufacturing overhead costs are included in the cost of inventory, whether it is finished goods, work-in-progress, or raw materials. This means that fixed manufacturing overhead costs are carried forward in inventory until the goods are sold.

Determining product vs. period costs

Each decision is intended to be in the best interest of the entity, even when a full costing approach causes the decision to look foolish. The fixed costs that differentiate variable and absorption costing are primarily overhead expenses, such as salaries and building leases, that do not change with changes in production levels. A company has to pay its office rent and utility bills every month regardless of whether it produces 1,000 products or no products at all, for example.

Variable costing provides a better view of marginal profitability, while absorption costing adheres more closely to GAAP and matches all production costs against revenue. Absorption costing can cause a company’s profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold. In addition to skewing a profit and loss statement, this can potentially mislead both company management and investors. Therefore, as we increase the number of units, the per-unit cost under absorption costing will reduce because each extra unit of production will absorb the fixed costs.

This approach assigns all manufacturing costs to the products produced rather than treating some costs as period expenses. The main advantage of absorption costing is that it complies with generally accepted accounting principles (GAAP), which are required by the Internal Revenue Service (IRS). Furthermore, it takes topic no 506 charitable contributions into account all of the costs of production (including fixed costs), not just the direct costs, and more accurately tracks profit during an accounting period. Advocates of absorption costing argue that fixed manufacturing overhead costs are essential to the production process and are an actual cost of the product.

They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. Under variable costing, the fixed overhead is not considered a product cost and would not be assigned to ending inventory. The fixed overhead would have been expensed on the income statement as a period cost.

On the other hand, variable costing treats fixed manufacturing overhead costs as period expenses. These costs are not allocated to units of production but are expensed in the period they are incurred. Consequently, variable costing only includes variable manufacturing costs in the cost of each unit produced. This approach can result in lower per-unit costs compared to absorption costing. Outdoor Nation, a manufacturer of residential, tabletop propane heaters, wants to determine whether absorption costing or variable costing is better for internal decision-making. The total of direct material, direct labor, and variable overhead is $5 per unit with an additional $1 in variable sales cost paid when the units are sold.

Therefore, the methods can be reconciled with each other, as shown in Figure 8.1.7. For example, if you know that your company’s rent will increase next year, you can use the period cost per day to estimate how much this will increase your monthly expenses. By making informed decisions based on data-driven analysis, management can improve the profitability of their business and create long-term value for their shareholders. There are two main methods of accounting for costs in a business – Absorption Costing and Variable Costing.

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.